- Leadership Tips for Startup Founders

- Posts

- Harnessing Silent Strength to Build Investor Trust

Harnessing Silent Strength to Build Investor Trust

Morning beehiivcommunity!

This newsletter turns experience into lessons you can apply to your startup. As a growth partner for visionary founders, we help sharpen leadership skills and unlock growth potential.

Fundraising: Inspire Your Investors Through Storytelling

“People will forget what you said, people will forget what you did, but they will never forget how you made them feel.” — Maya Angelou

Introverted founders often struggle with fundraising because the process demands networking, public pitching, and high-energy social interactions that can feel draining or unnatural. You may find it challenging to promote yourself and build investor connections, which hampers your ability to confidently share your vision and secure financial backing.

This week’s post (linked below) encourages you to approach fundraising not as a performance but as a strategic, genuine, relationship-driven process where your natural strengths can shine.

Startup Spark

"It is amazing what you can accomplish if you do not care who gets the credit." — Attributed to Harry S. Truman

For startup founders, embracing a collaborative mindset leads to stronger teams, more innovative solutions, and ultimately, a greater chance of success.

Create a team-oriented culture where everyone's contributions are valued. This approach not only sparks innovation but also accelerates progress. By generously giving credit, you build an environment that attracts and retains talented people who feel appreciated.

When team members see their work recognized, it cultivates trust and loyalty. This significantly enhances both morale and productivity.

Expert Tips for Startups

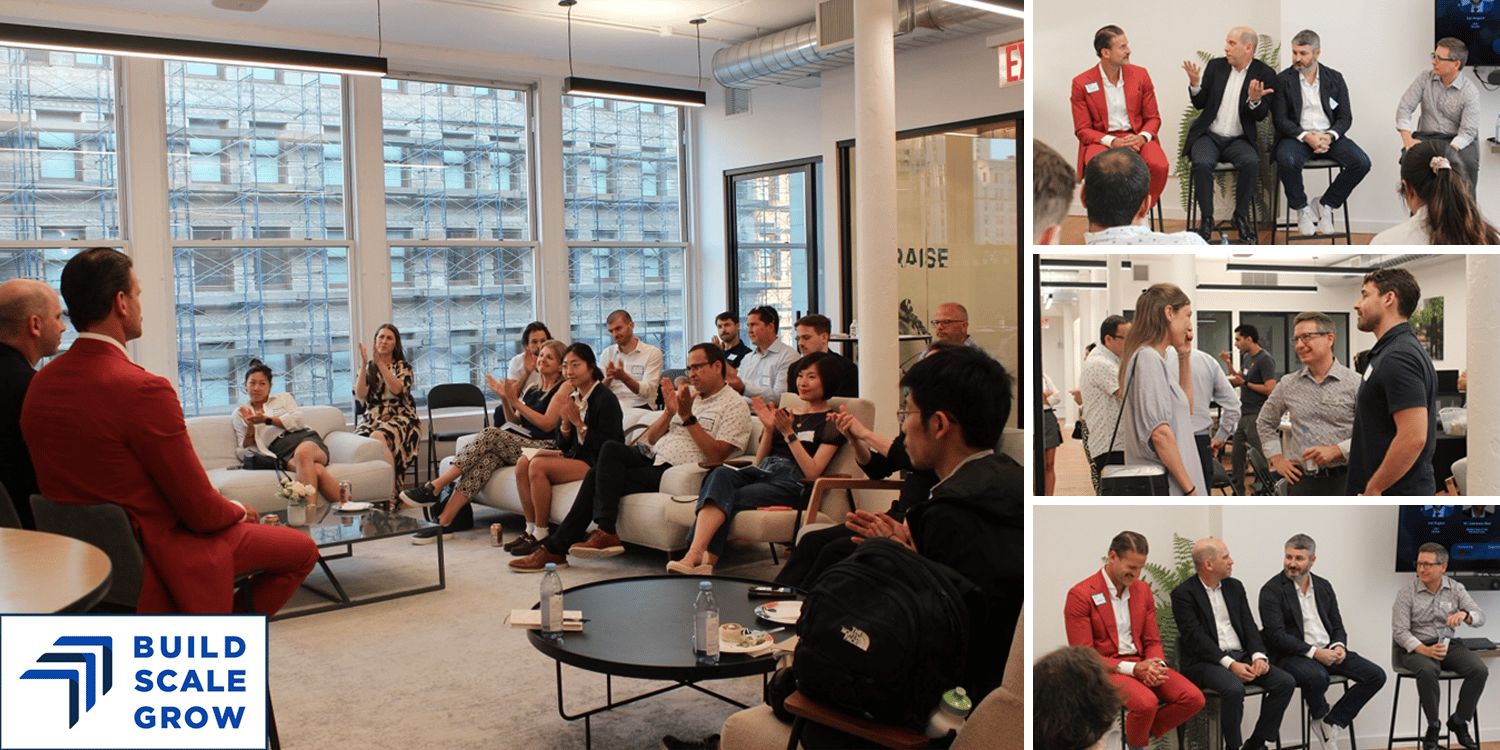

Photos by Leah Friedman

Highlights from the Navigating Secondary Markets Event

Last week, we explored how 409A valuations, employee incentives, and secondary market liquidity impact valuation and employee engagement.

The session offered practical guidance on 409A valuation protection, the timing of secondaries, the impact on future fundraising or IPOs, and actionable steps to avoid common pitfalls and drive company success.

Here are some highlights from the panelists:

“Secondary transactions are a common part of a private company’s lifecycle, and navigating the nuances of how they are structured is critical to maintaining the integrity of the company’s 409A valuation.”

—Zak Nugent, CEO at Scalar, a valuation firm specializing in tax, financial reporting, transaction advisory, and litigation.

“Attracting, motivating, and retaining great talent is paramount in any organization, and doing so in a scaling startup can be especially challenging. It was great to share the panel's experiences on how stock compensation and secondaries can support a company's most important asset—its people.”

—Dr. Lawrence Skor, Global Head of Tax at Checkout, with previous experience at GE, Oracle, and Coinbase.

“Secondary transactions and redemptions can be great tools to address various issues, but you always need to be thoughtful about what issue you are trying to address and why, they are tools not ends unto themselves.”

—Andrew Ritter, Partner at Wiggin and Dana LLP, where he is Co-Chair of the firm’s M&A and PE Practice Groups.

The event was sponsored by Espresso AI, a company that helps customers save up to 70% on their Snowflake bills.

The New York Tech CFO Group: Where CFOs Meet and Learn from Peers

The New York Tech CFO Group is a free, informal forum where finance leaders exchange insights on strategic planning, benchmarking, and financial solutions.

Since our founding in 2016, our community of CFOs and finance heads has maintained an active email group and hosted regular in-person gatherings—from casual happy hours and breakfasts to focused educational and networking events.

Events this year include:

The CEO-CFO Alliance: Growth, Challenge, and Collaboration

Navigating Secondary Markets

How Non-Tech Companies Are Winning with AI and Automation

Fundraising Tradeoffs: Lessons VCs Don't Teach You

Automation and AI in the Finance Stack

Regular Happy Hours and Breakfasts

For membership and sponsorship information, reply to this email to learn more.

Need Some Help?

What if the quietest person in the room is the one who changes the world?

Build Scale Grow provides expert strategies and clear metrics for social impact, EdTech, and health tech startups, with a focus on introverted founders. With five successful M&As in ten years, we’ll help your startup reach its full potential and beyond.

Book a free 30-minute call HERE to see how we can help.